"Credit score" is a term you'll hear over and over again, and it's one of the most important numbers when it comes to your finances. A credit score represents your credit history and is represented by a three-digit number ranging between 300-850.

Why is this important? Credit scores are a big deal because it's used to assess how financially trustworthy a person is. Generally, the higher your credit score, the more trustworthy you appear to lenders. However, according to recent surveys and studies, it's not just lenders who are interested in your credit score anymore.

7 WAYS YOUR CREDIT SCORE CAN IMPACT YOUR LIFE

It's normal to need a loan for larger purchases, such as a car or a house. One of the main things lenders look at is your credit score and credit report because it shows your financial history. Have you paid bills on time? What type of loans have you had in the past, and have you paid them back? How much overall debt do you have? Lenders look at this and get a pretty good idea if they'll be able to give you a loan or not and what type of risk might be associated with your loan.

This goes hand-in-hand with your loan approval. The better your credit score, the better interest rate you will typically receive from your lender. This is important because of what it can save you over the long haul. For example, let's say you decide to buy a house. You need $100,000.00 for your home loan, and you decide to have a 30-year mortgage. The interest rate you receive for the home loan can make a big difference over time. Just a 1% difference in your interest rate can result in over $20,000.00 worth of savings!

- Renting

Landlords and property managers are always on the hunt for good tenants, and frequently one of the first things they check along with your housing application is your credit score.

- Routine Bills

Financial institutions aren't the only ones looking at your credit score. Cell phone carriers, utility offices, and insurance agencies are just some examples of other companies that look at your score to determine if they should charge extra fees or a higher interest rate.

When opening a credit card, a good credit score can help get you preapproved for cards that offer rewards and benefits. You'll also be more likely to have a lower interest rate and a higher spending limit. The opposite is also true; a lower score makes it harder to get approved and typically has a lower spending limit and a higher rate.

- Relationships

According to a recent survey by Bankrate, nearly 4 in 10 adults say knowing someone's credit score would affect their willingness to date that person. Other studies, such as a 2015 report by the Board of Governors of the Federal Reserve, found a correlation between a couple's credit score numbers and the likelihood of how long a couple will stay together. While a credit score shouldn't be the primary motivation behind your dating decisions, it is important to understand someone's attitude towards money.

- Hiring

Several states (including Tennessee) allow employers the right to run credit reports on prospective employees. The credit report provided is not the same one your traditional financial lender would see, but it can still provide an overall idea of an individual's financial health.

WHAT YOU CAN DO

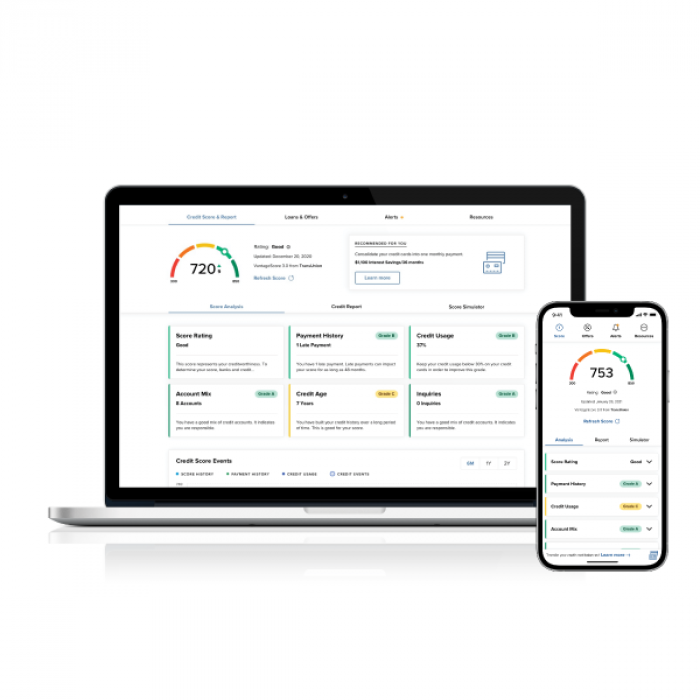

The first step to staying on top of your credit score is to know what it is. If you're a Member of Knoxville TVA Employees Credit Union, you can go online or log in to the mobile app to view your credit score anytime (and at no cost!). The only condition is you have to be the primary account holder to view your score. Still looking for other ways to view your score? Look online for websites allowing you to check your credit score for free.

Awareness is the first step. From there, you can devise a game plan to help you increase your credit score. That way, your credit score works for you and not the other way around.