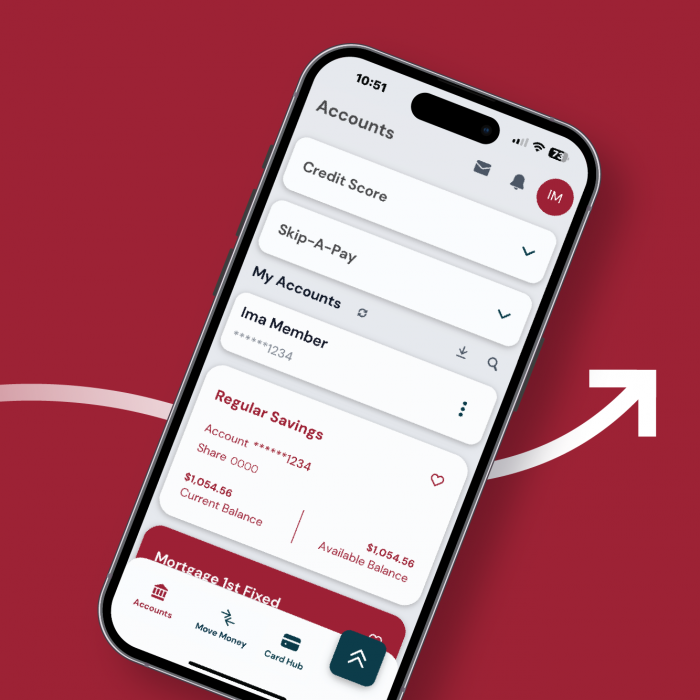

Mobile Banking

Access Your Money Anywhere!

Wherever life takes you, the KTVAECU® Mobile App 1 keeps you connected to your money:

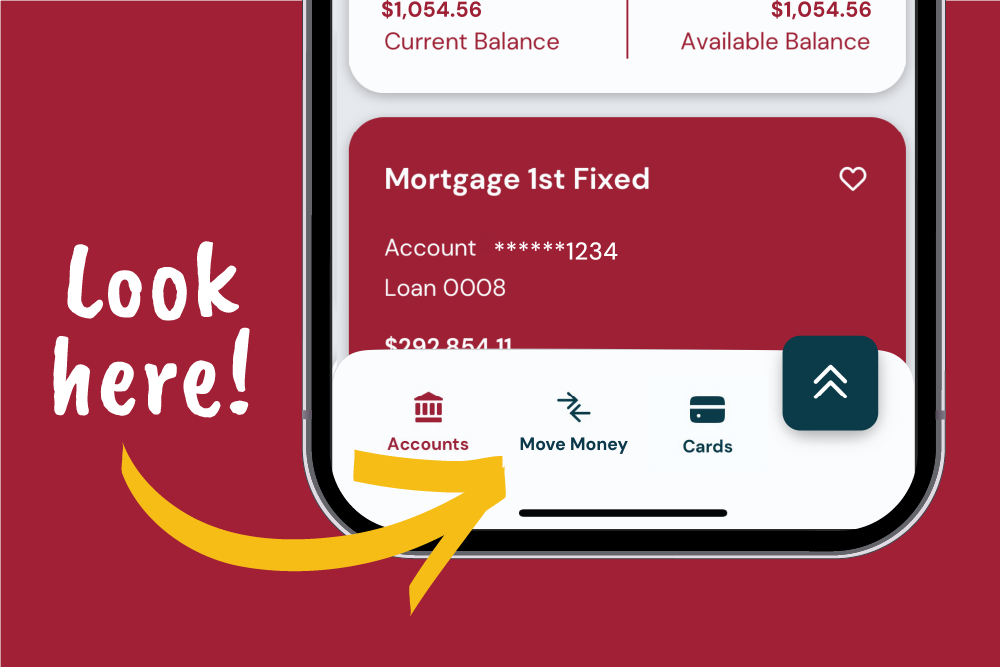

- View account balances

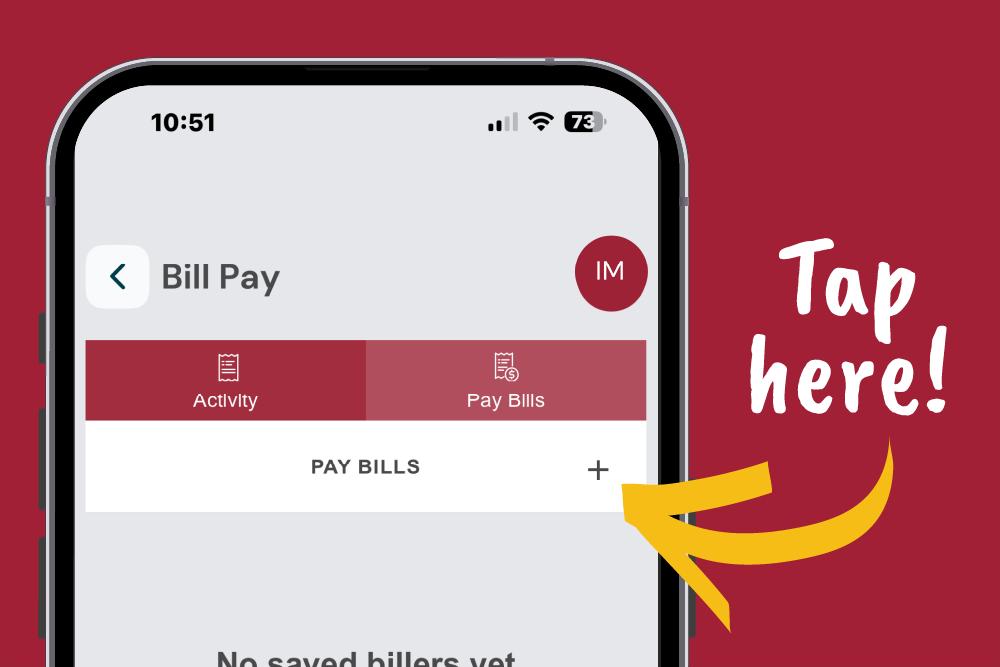

- Make payments

- Deposit checks

- Transfer money

- Turn your cards on/off

Everywhere Banking

From your couch to the other side of the world, the KTVAECU® Mobile App 1 keeps your accounts right by your side! Take a look at some Member-favorite features designed to help YOU manage your money, from anywhere.

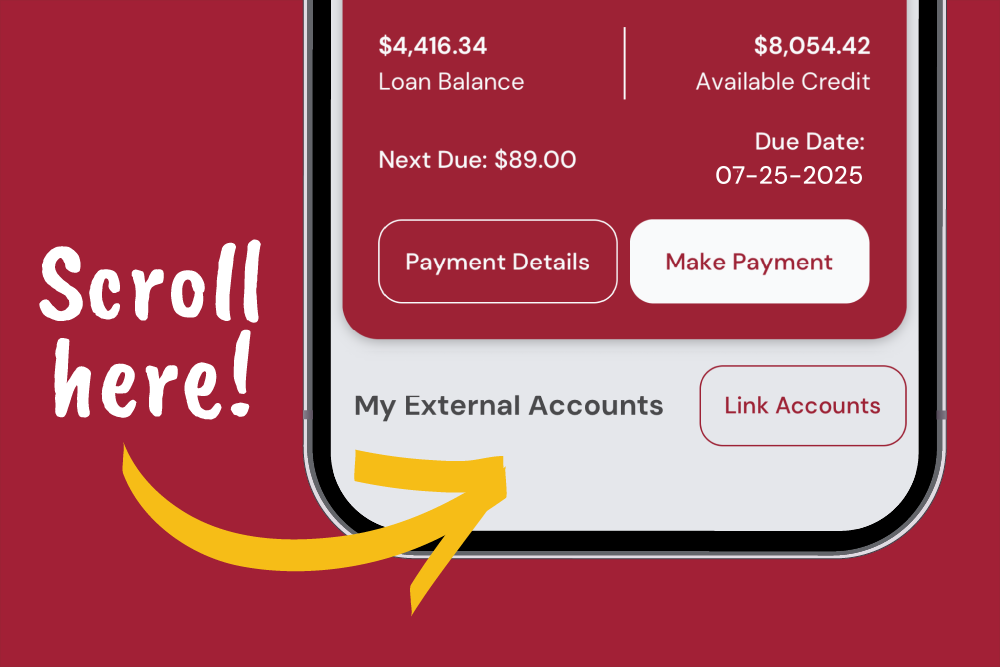

- Transfer money between accounts and other financial institutions

- Move money to friends, family, and businesses

- Add cards to your digital wallet through Control My Card by KTVAECU®

- Connect external accounts easily with PlaidTM

- Deposit checks on the go

- Customize real-time Account Alerts

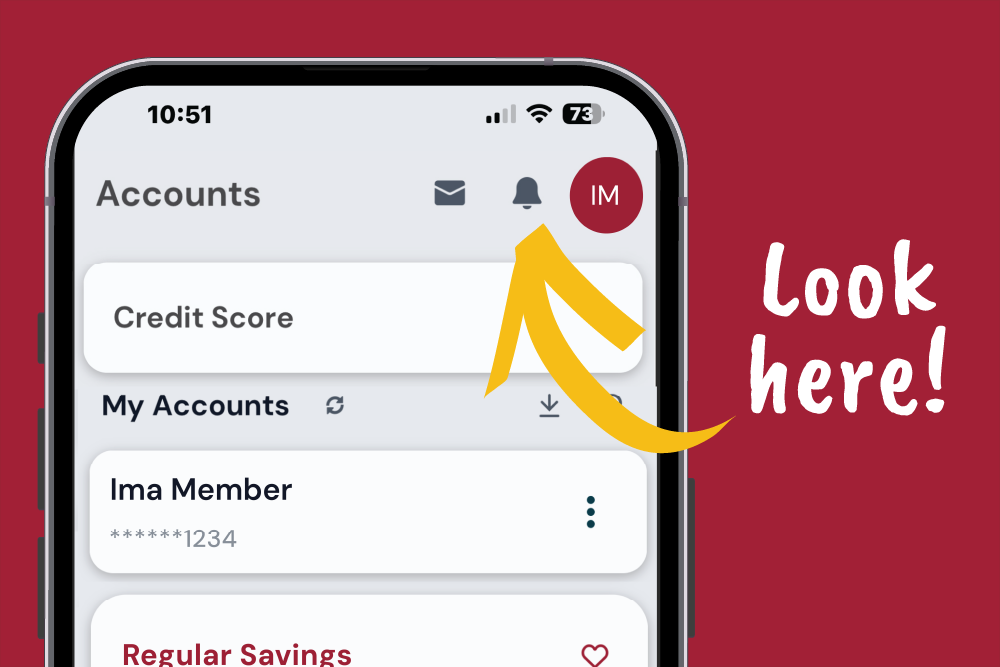

Check Your Credit Score 11

Build or maintain your credit score anytime, anywhere! Just log into the app to see your current score, set personalized goals, and track changes to your score. The best part? It's FREE for Members!

- Check your credit score anytime.

- See tips to improve your score.

- Know what's affecting it.

- Get notified any time your score changes.

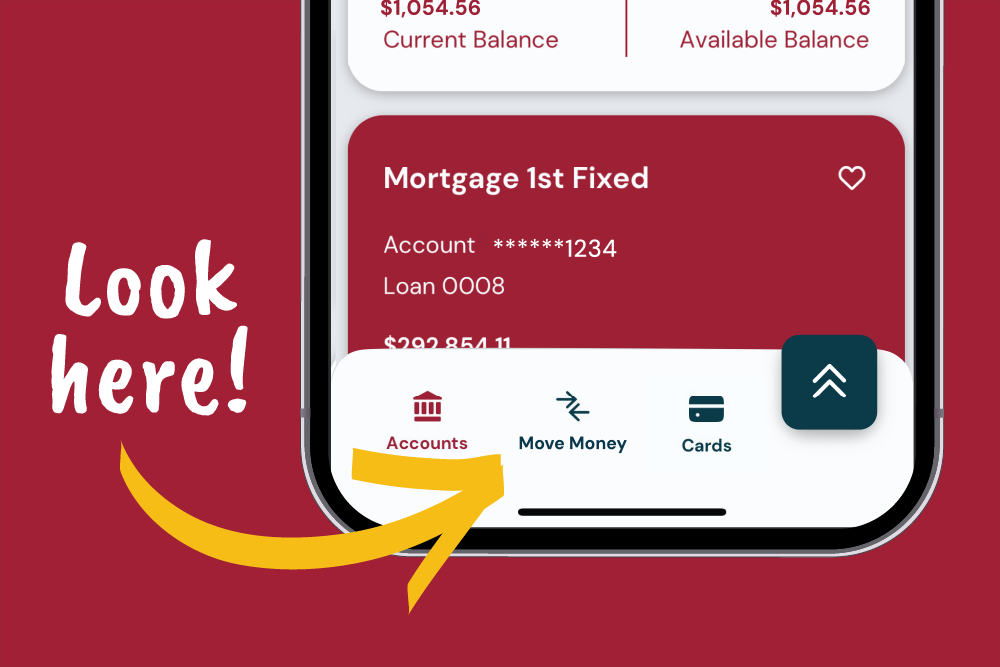

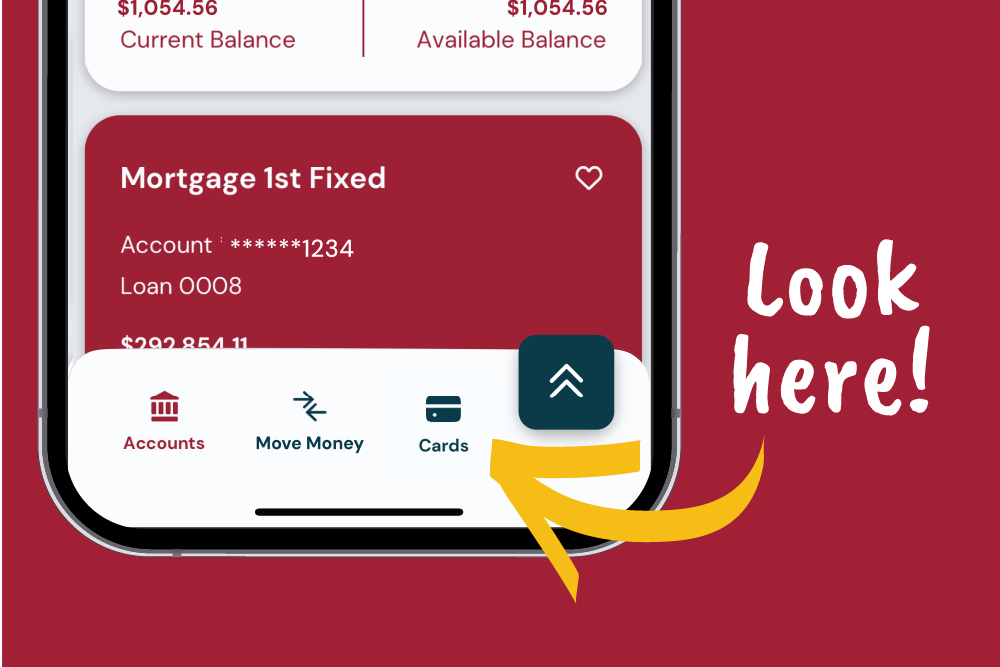

Pay-A-Person 7

Transfer cash to friends and family with Pay-A-Person! It's quick and easy, and your recipient doesn't even have to be a KTVAECU Member.

To get started with Pay-A-Person:

- Select Move Money

- Choose Pay-A-Person

- Tap the plus icon to add a new contact

- Select the funding account

- Enter the amount you want to send

- Tap Submit