Teen Debit Card

Spend Smarter with a Teen Checking Account 2

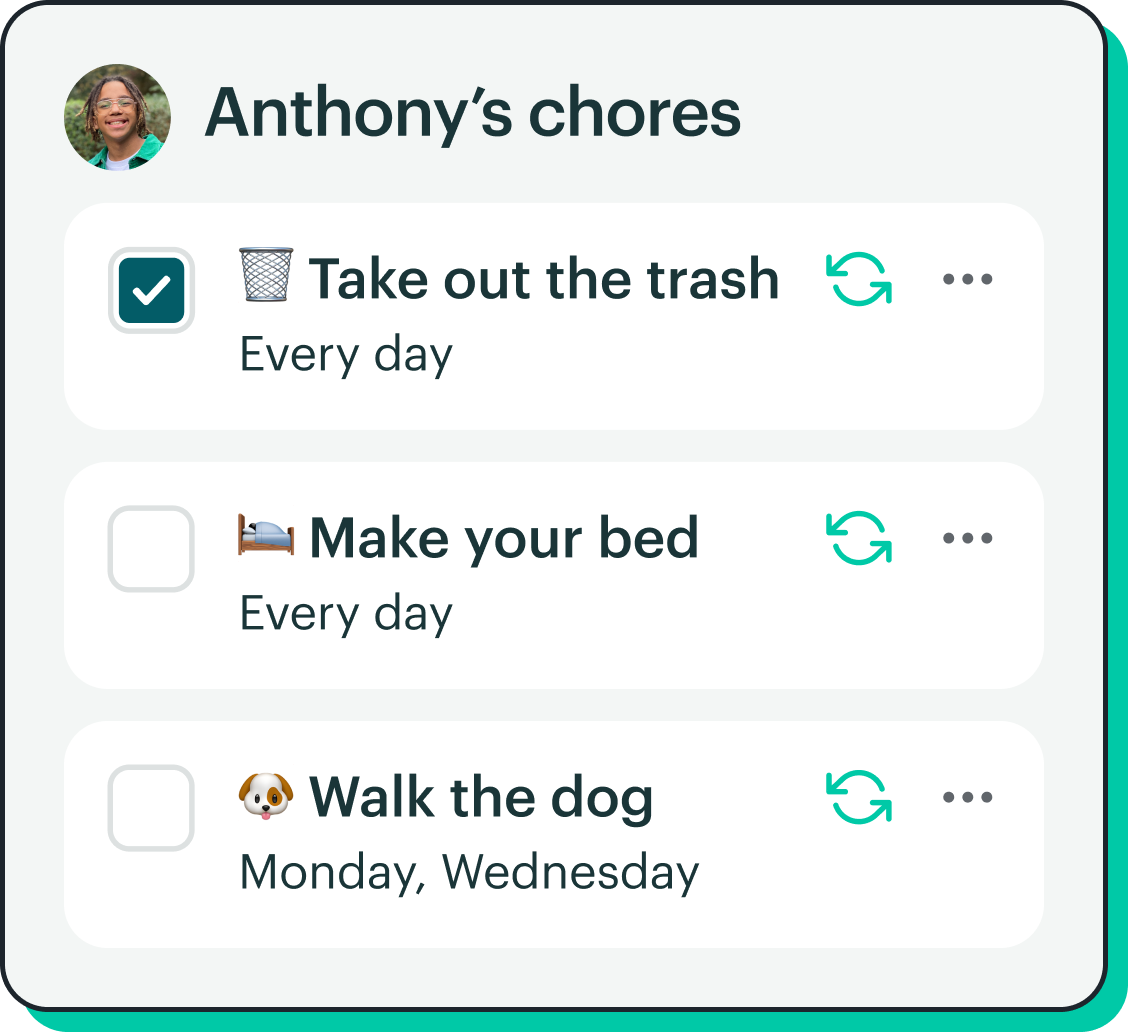

Ready for more financial freedom? With a Teen Checking Account:

- Get your own debit card

- Score your money early with direct deposit 3

- See what you've spent, and what's left, with the mobile app

Check out Our Podcast!

Want to boost your money knowledge even more? Money Moves by KTVAECU® 10 is your go-to podcast for tips, tricks, and answers to your money questions.

Tune in to hear the hottest financial topics turned into fun, relatable conversations and stay in the know about all things money!

Find us on your favorite platform!

Level Up Your Money Game

Who you trust with your money partner is a big deal. That’s why we partner with you to offer resources you need to become a money champion! From great digital banking tools to friendly in-branch service, we’re here to help you master lifelong money skills. Check out our YouTube channel for quick tips and tutorials on popular money topics!